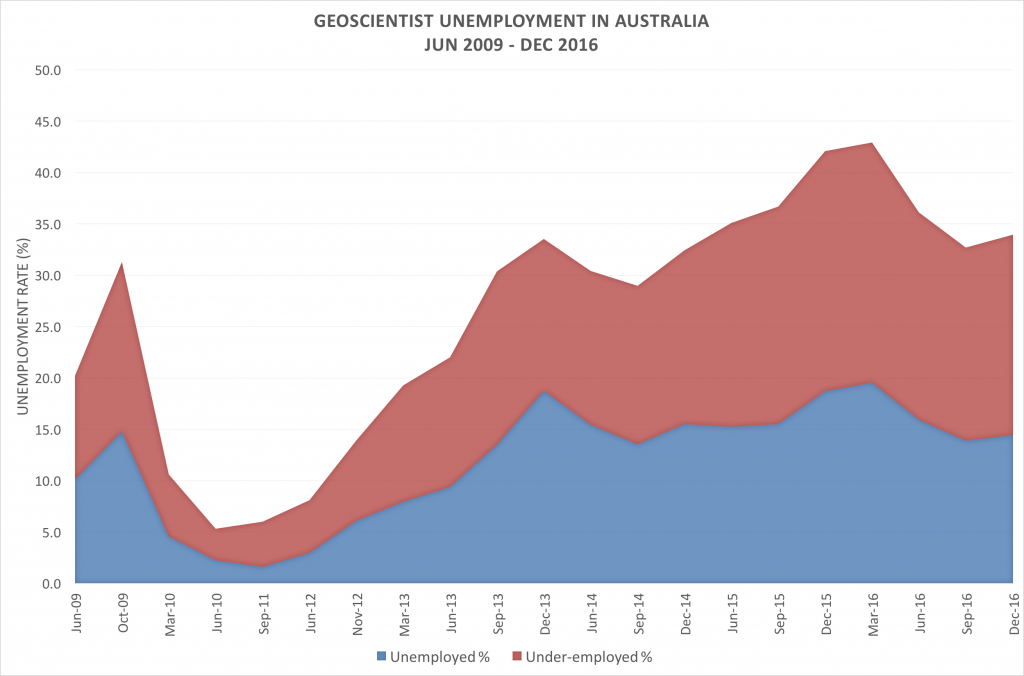

The improvement in employment prospects for Australia’s geoscientists evident during 2016 came to an end in the final quarter of 2016.

At 31st December 2016, the unemployment rate amongst Australian geoscientists was 14.4% and the under-employment rate was 19.5%, up slightly from 13.9% and 18.8% respectively at the end of September 2016. The unemployment and underemployment rates are, however, lower than those recorded earlier in 2016.

Geoscientist unemployment and under-employment in Australia June 2009 – December 2016

More than half of Australia’s self-employed geoscientists were unable to secure more than one quarter of their desired workload during the quarter, pointing to a real unemployment rate of 24.5%, up slightly from the 24.2% recorded at the end of September 2016.

The data for this latest instalment in the AIG Australian Geoscientist Employment Survey series was collected during February 2017. The survey received 485 responses, down slightly on previous surveys, reflecting the time of year, but still considered to be a reliable sample with an estimated one in ten to one in fifteen geoscientists contributing to the survey.

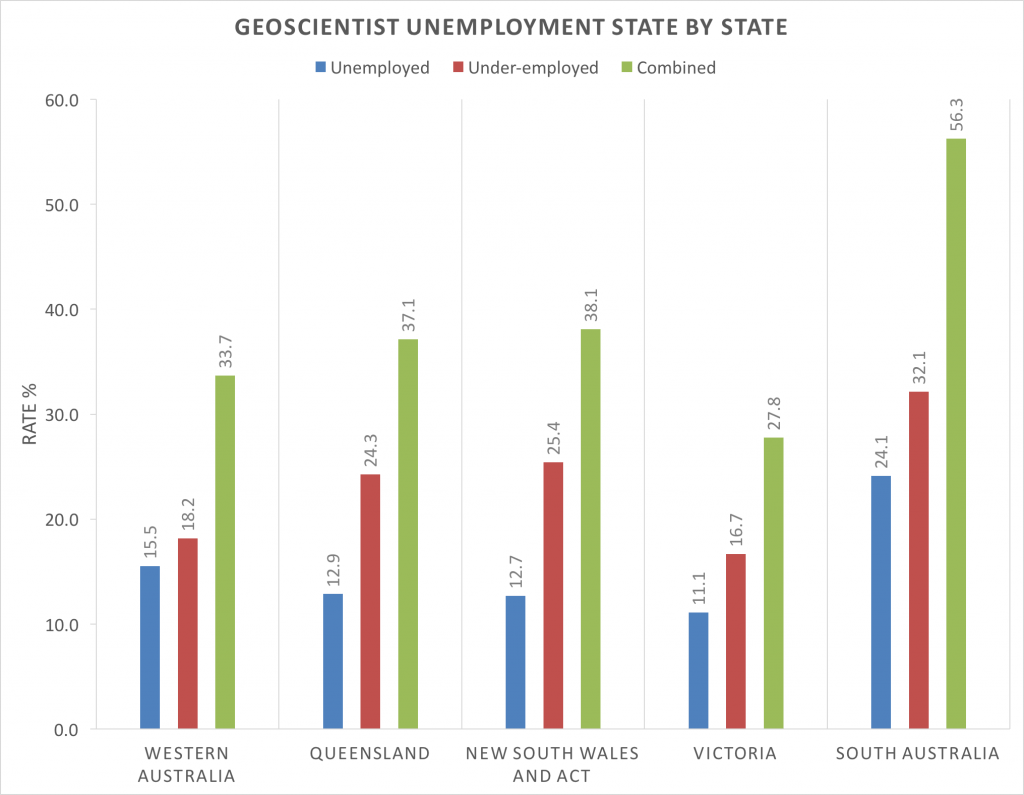

The employment survey results for different states were again mixed.

The highest combined rate of unemployment and underemployment was again evident in South Australia, followed by New South Wales/ACT and Queensland.

Geoscientist unemployment and underemployment by State

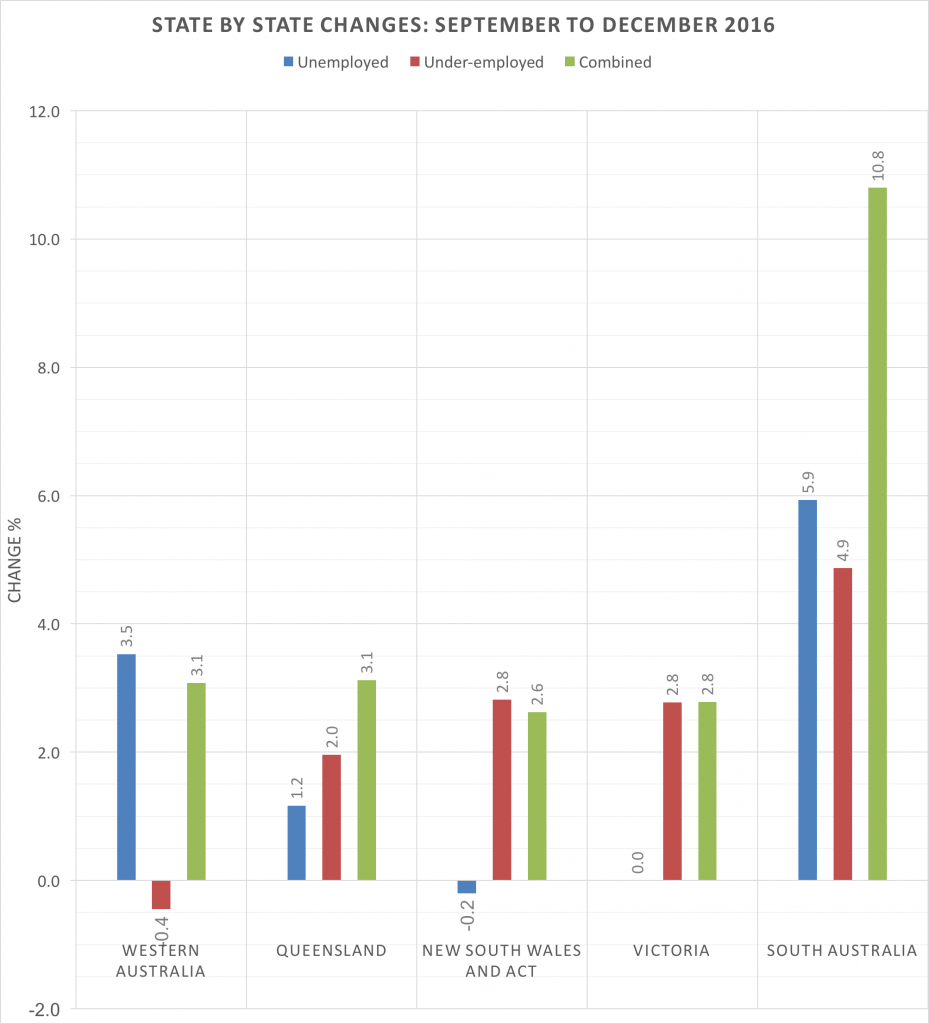

The unemployment situation worsened in South Australia, Western Australia and Queensland, but remained static in Victoria and improved marginally in New South Wales and the ACT. Under-employment increased in every state except Western Australia where a marginal decrease was recorded.

Changes in state unemployment and underemployment during Q4 2016

Long term unemployment and under-employment remained a feature of the survey. More than 56% of unemployed and underemployed geoscientists have been without work for more than 12 months, down by less than 2% from the previous survey. Almost half (49%) of unemployed and under-employed geoscientists said that they were not confident of regaining their desired level of employment within the next 12 months. Almost 34% of unemployed and under-employed geoscientists were seeking employment in another field, with a third of those seeking to leave their profession permanently.

Amongst geoscientists in employment, one in ten returned to work after a period of unemployment or under-employment between September and December 2016.

The breakdown of employment by industry sector differed little from previous surveys. Just over 64% of respondents work, or seek work in mineral exploration. A further 15% work or seek work in metalliferous mining. Some 7% of geoscientists work or seek work in energy resource (coal, natural gas and petroleum) exploration and production.

The survey results were described as disappointing by AIG Council member Andrew Waltho. “Hopefully the survey results reflect a seasonal pause in the gradual recovery of employment opportunities for geoscientists but, equally, the results may show that the recovery being talked about in the Australian resources sector remains fragile”. “The survey results clearly demonstrate that resource exploration in Australia remained flat through to the end of 2016, consistent with exploration expenditure figures reported by the Australian Bureau of Statistics at the end of February 2017”. “Improved prices for mineral commodities during 2016 has not translated into increased exploration investment and project pipeline renewal” Mr Waltho said.

“Almost half of Australia’s geoscientists work for mid-tier and junior exploration and mining companies that continue to struggle in an environment where investment is difficult to attract and access to land for any form of exploration continues to be difficult” Mr Waltho said. “The area of each state under exploration title remains considerably lower than in previous years”. “In 2011, for example, 25% of Western Australia was covered by exploration licences”. “In February 2017, this figure was 14%”. “A similar trend is evident in Queensland, with 16% falling to 9% over the same period, and New South Wales, with 26% in 2011 falling to 7.5% today”.

“The Fraser Institute annual survey of mining companies for 2016 saw Western Australia and Queensland featuring in the top 10 most attractive jurisdictions for exploration investment globally, but this isn’t being reflected in actual investment needed to create jobs and sustain one of the most important sectors of the Australian economy”.

AIG asked its members what should be done to catalyse exploration in Australia following the September 2016 survey. Improved access to land for low-impact reconnaissance exploration, the first step in resource discovery, featured prominently in the responses received. “Reduced red-tape associated with securing equitable and considered access to land for exploration would dramatically improve the attractiveness and productivity of exploration investment, contributing to resource discovery” Mr Waltho said.